WE ARE UPGRADING OUR TECHNOLOGY!

IMPORTANT DATES TO REMEMBER:

Friday, January 30, 2026

Credit Union open for normal business hours

Online banking and Mobile App unavailable starting at 11AM until 2/3/26 Shared Branch unavailable.

Debit cards will have temporary daily limits until 2/3/26

Saturday, January 31, 2026

Credit Union will close at 1:00PM.

Monday, February 2, 2026

Credit Union will be closed.

Tuesday, February 3, 2026

Credit Union will be open.

Access to the NEW Online Banking & Mobile Banking available.

WHAT WILL BE AFFECTED DURING THE UPGRADE WEEKEND JANUARY 30 to FEBRUARY 3?

Online Banking

Unavailable from Friday, January 30 at 11AM to Tuesday, February 3.

Starting on February 3, All members must re-enroll in online banking using their member number and the last 4 digits of the primary member’s social security number. If you are currently able to view accounts you are joint on, you will need to contact the credit union to set up this access. Initially only access to accounts you are the primary on will be viewable when you log into online banking.

Any scheduled transfers in online banking, either between CU accounts or to external accounts will need to be set up again in the new online banking system. Please note: transfers to or from external accounts will not available until March 2026.

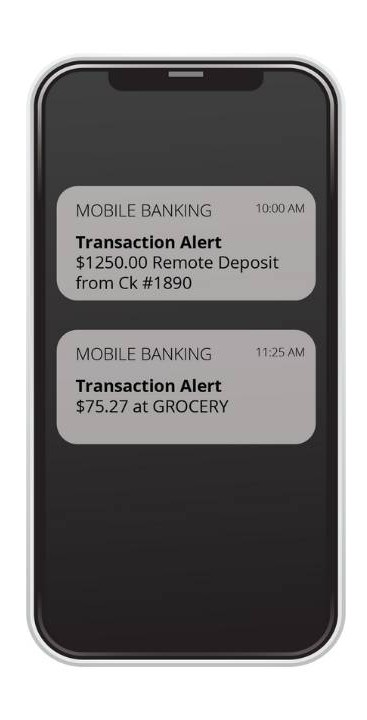

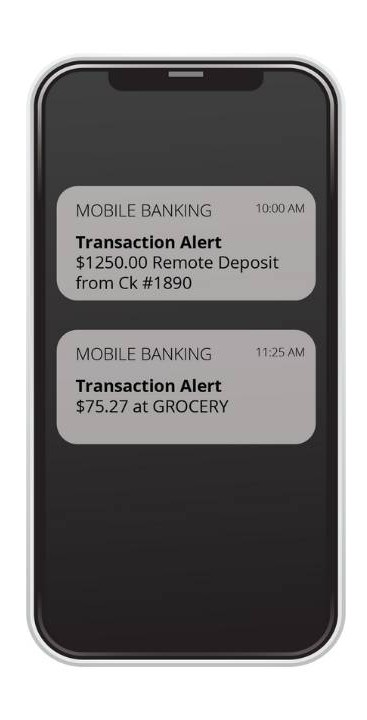

Mobile App

Unavailable from Friday, January 30 11AM to Tuesday, February 3.

Uninstall the current Access CU Mobile App after January 30, 2026.

Install our NEW MOBILE APP on or after February 3, 2026.

Please note: Mobile Deposits will not be available immediately after the upgrade. Keep checking back for availability.

Bill Pay

Not available after Friday, January 30 at 11AM to until new system is online.

***Please note, any scheduled bill payments will continue to process. You will not be able to add or change any bill payments until the system is back online.

Debit Cards

There will be temporary daily limits on your debit card transactions from 1/30/26 until 2/3/26.

During this time, debit cards will function for purchases and ATM withdrawals but with temporary daily limits. Withdraw cash before the upgrade if possible. Use credit cards for purchases during the upgrade. Credit cards will not be impacted by the change.

Electronic Transactions

ACH transfers and automatic payments will continue on or after Tuesday, February 3 and thereafter as scheduled. Check your accounts on 2/3/26 and let us know if a transfer was missed.

After 2/1/26, Creating new External ACH transfers will not be available until March 2026.

Statements

All members will receive a paper statement for December 2025 and for January 2026.

If you currently access statements online, download any statements you may need prior to 1/30/26. After that date, you will need to contact the credit union for copies of statements.

How Can I Prepare for the Upgrade?

Here are a few steps you can take to prepare for the Upgrade and the transition of your account information:

- Update your contact information including cell # and email address.

- Stay Informed about the Upgrade through our website or social media.

- If you have set up scheduled transfers on home banking, they will no longer be valid after January 30, 2026. Please take note of any transfers you have set up so you can set these up in the new system.

- Download copies of any online statements you may need.

- Review your current payments, transfers and alerts to ensure continuity.

- Download the new Mobile App on 2/3/26

FAQs - Frequently Asked Questions

What is a Core Conversion?A core conversion is an upgrade to our central software platform that enhances transaction processing, member services, and security.

While the upgrade is mainly behind the scenes, some service interruptions will occur. We aim to make this transition smooth for you.

- Member numbers

- Member Checks

- Debit Cards

- Access CU Routing Number

- Credit Union Hours

- Credit Cards

- Bill Payment information

- New Online Banking

- New Mobile App

- New Audio Response System

- The ability to turn your debit card off and on via online banking.

No, you will need to re-enroll with new credentials starting February 3, 2026. You will initially sign on to the new online banking with your member number and the last four of the primary members SSN.

Yes, they will continue as scheduled.

Absolutely. We have taken all necessary precautions to ensure your information remains secure.

Yes, your checks remain valid.